Over the past couple of days, several intriguing developments have surfaced in the synthetic green sector — from design directions and raw material fluctuations to the mounting price pressure at the wholesale end. Beneath these shifts lies a subtle turning point for the industry. For B2B buyers such as shopping malls, hotels, and exhibition decorators, recognising these trends may soon become a sharper competitive edge than negotiating prices. Let’s look at the latest updates and decode what they mean for the artificial plants supply chain and market strategies.

Ⅰ. News Highlights (Recent 48 Hours to Past Two Weeks)

While not every piece of news falls strictly within the 48-hour window, each reflects the market’s current direction:

- Price pressure intensifies in mid-range artificial trees

According to a recent market update by Sinleen, the artificial tree wholesale segment has seen its “mid-price range (USD 80–150)” become the most competitive battleground, with manufacturers cutting margins and occasionally downgrading materials to preserve orders. (SinleenPlants.com) - Overall market momentum remains strong

The latest forecast suggests the global artificial plant & synthetic greenery market could reach around USD 2.4 billion by 2026, growing at a CAGR of roughly 5.6%. (SinleenPlants.com)

Another independent report places the 2025 market valuation at about USD 5 billion, projecting a 7% CAGR between 2025 and 2033. (Archive Market Research) - Design trends: hyper-realism and eco-conscious materials

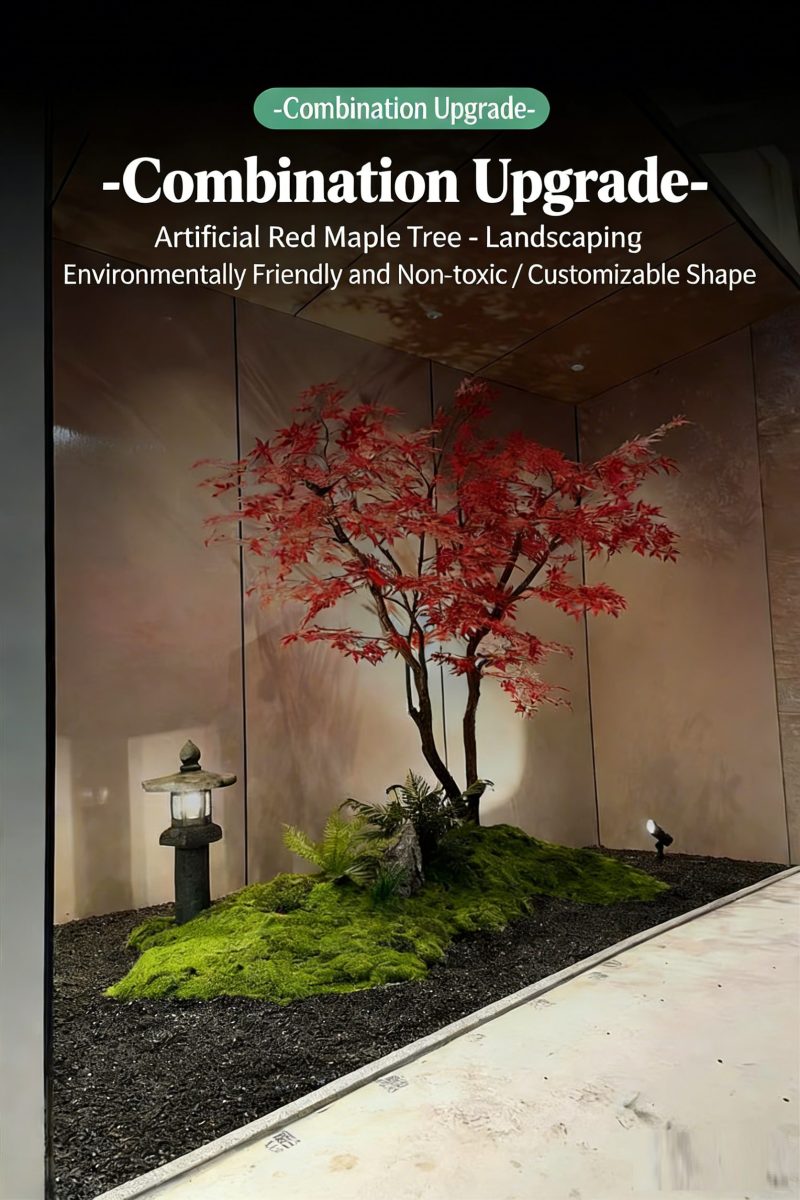

A leading manufacturer recently noted that this year’s commercial market has shown unprecedented appetite for “hyper-realistic design + eco-friendly materials,” especially in indoor statement trees and event installations. (HAC Artificial Tree)

The same trend extends to UV-resistant coatings, low-VOC resins, and recyclable support frames.

Though not all of these headlines are strictly “breaking news,” they form the undercurrent shaping current procurement decisions. Let’s unpack what they reveal from several key angles.

Ⅱ. In-Depth Analysis

1. Market & Trend Outlook: Growth persists amid profit polarisation

Even with margin pressure and heightened rivalry, multiple sources remain optimistic about the industry’s mid-term trajectory:

- In the U.S. market, Technavio projects that the artificial plants & flowers segment will grow by an additional USD 380 million between 2025–2029, with a CAGR of 3.4%. (PR Newswire)

- Globally, Archive Market Research estimates the market will hit roughly USD 5 billion in 2025, maintaining a 7% CAGR through 2033. (Archive Market Research)

Yet this expansion is far from evenly distributed. The mid-range price tier—USD 80 to 150—is increasingly saturated. Fierce price wars are pushing some manufacturers to compromise on branch density, base quality, or finish thickness. Unless design and branding create stronger barriers, profit margins may flatten further.

Interestingly, the upper end of the market is diverging. Clients are now willing to pay for heightened realism, sustainability credentials, and extended durability. For B2B buyers, that means assessing suppliers not just on cost, but also on “authenticity + eco-value + longevity.”

2. Technology & Material Innovation: Upgrading both appearance and substance

- Hyper-realistic finishes: Beyond visual resemblance, texture and tactile fidelity are now priorities. Enhanced silicone coatings, nano-patterned leaf surfaces, and moisture-mimicking films are increasingly common in premium lines.

- Improved UV and weather resistance: For semi-outdoor or exterior settings, longevity under UV exposure and humidity is key. Next-gen UV stabilisers and anti-ageing resin blends are gaining traction.

- Sustainable materials on trial: Some innovators are experimenting with recycled plastics, plant-based biopolymer resins (e.g. PLA hybrids), and biodegradable structural parts. While these remain niche, the direction is unmistakable.

- Digital design and automation: CAD modelling, 3D printing of moulds, automated leaf-bending, and precision painting systems are making small-batch customisation economically feasible.

This evolution marks a clear shift from a “cost-driven” model to a “value-driven” one: whoever balances lifelike design, sustainability, and durability will likely outpace the competition.

3. Environmental & Policy Drivers: Pressure and opportunity intertwined

Sustainability is no longer a soft topic—it’s becoming a procurement criterion.

- Time Magazine recently reminded readers that while artificial plants may look perfect, their manufacturing and disposal still entail environmental costs. (Time.com)

- Meanwhile, in the live-plant world, the UK Chelsea Flower Show postponed its “peat-free” target from 2025 to 2028, showing how challenging true eco-transition can be. (Financial Times)

Yet this same context opens a door: if synthetic greenery producers can highlight recycled inputs and low-carbon manufacturing, they could reposition themselves as the “greener alternative” for interiors, hospitality, and commercial builds.

For procurement teams, that means incorporating “carbon footprint,” “recyclability,” and “end-of-life strategy” into supplier evaluation—not just price comparisons.

4. Supply Chain & Trade Volatility: Dual stress from raw materials and logistics

- Materials: Resin, dyes, metal bases, and adhesives—all remain price-sensitive to global oil markets, freight tariffs, and energy costs.

- Competitive intensity: With mid-tier profits squeezed, many suppliers are trimming specifications—plastic instead of metal bases, fewer fronds per stem—to stay viable.

- Logistics: Ocean freight remains unpredictable; extended lead times and rising shipping costs are pushing B2B buyers to reconsider full-container versus local warehousing models.

- Regulations: Western import controls on plastics and chemical additives may tighten. Buyers unaware of component origins risk compliance exposure.

Stability and resilience in supply partnerships may soon outweigh minor unit-cost differences.

Ⅲ. Industry Insights & Future Directions

- The leverage of price competition is shifting: Pure cost-cutting strategies are running out of road. Winning suppliers will stand out through design differentiation, upgraded materials, and consistent service.

- Green credentials will become baseline: “Recyclable,” “low-carbon,” and “modular” are set to become the new entry standards. Buyers adopting sustainability audits early will gain negotiation leverage later.

- Polarisation of custom vs modular: Off-the-shelf items will still dominate volume, but modular customisation is rising fast. Suppliers offering flexible, mix-and-match systems can reduce inventory risk and improve responsiveness.

- Collaborative procurement: Shopping centres, hotels, and event decorators may move towards regional purchasing alliances to share logistics and stock, cushioning against cost swings.

- Sustainability as the new trust marker: Manufacturers experimenting with biobased resins, recycled inputs, or product take-back schemes could soon enjoy brand loyalty advantages similar to “fire-resistance” or “UV-grade” certifications today.

Equally, innovations in lifecycle management—warranty, repair, parts replacement—may soon determine who secures long-term contracts.

Ⅳ. Conclusion & Reflection

Not long ago, artificial greenery was the “last-resort” option for commercial interiors. That perception is fading fast. When executed with high realism, eco-friendly materials, and thoughtful service, synthetic plants become a legitimate, even premium, décor solution.

For B2B buyers, the real question ahead is no longer “who’s cheapest,” but “who’s most reliable and forward-thinking.” Supply-chain stability, sustainability, design uniqueness, and after-sales performance may soon outweigh price as the deciding factors.

From my perspective, the years 2025–2027 will define the industry’s great divergence. Those mid-tier manufacturers who build defensible value through design or green innovation will secure steadier order pipelines, while pure cost-cutters risk margin erosion and eventual exit. For professional buyers—malls, hotels, exhibition contractors—partnering early with suppliers committed to sustainable transformation could prove the most strategic move of the decade.